Competitor backlink gap analysis in under an hour: workflow

Do competitor backlink gap analysis in under an hour using a simple workflow to spot missing authority tiers and topic-relevant sources fast.

What you should be looking for (and what to ignore)

Backlink exports get messy fast because they mix everything together: strong editorial mentions, weak directories, sitewide footer links, scraped pages, and repeats across subdomains. You can spend an hour cleaning a spreadsheet and still not know what to do next.

A competitor backlink gap analysis should answer one question: what kinds of links help your competitors rank that you don’t have yet? Not every missing URL is a real “gap.” You’re looking for patterns you can copy, not a random pile of domains.

Two gaps matter most:

Authority tier gap. If competitors have mentions from high-trust publications, major companies, or well-known industry sites and you only have small blogs, you’re missing an entire layer of authority. One or two links in that tier can matter more than dozens of low-value placements.

Topical fit gap. A strong link isn’t just powerful, it’s relevant. If you sell accounting software, a finance or small business publication usually moves the needle more than an unrelated general news mention.

To avoid wasting time, skip links that tend to inflate counts without helping rankings: thin directories, spammy aggregates, link farms, and sitewide footer/blogroll links. Also skip weird one-offs (random forum scraps, scraped copies) and links pointing to pages you would never recreate (expired promos, temporary campaigns).

A quick example: three competitors all have a handful of links from respected tech and business publications, plus many mid-tier niche blogs. You already have the niche blogs, but none of the top-tier mentions. That’s a clear authority tier gap, and it’s actionable.

Set the scope in 5 minutes

The fastest way to lose an hour is to analyze “all backlinks” for “all competitors.” Pick one focus: a single target page (like a product or pricing page) or one topic cluster (like “HR compliance software” or “email deliverability”). You’re trying to understand what supports rankings for that slice, not build a complete backlink database.

Open one backlink tool you trust and a fresh sheet. Keep the columns simple so you’ll actually use them later: source domain, example URL, competitor page linked, anchor, page type (blog/resource/news), and notes.

Set a hard time box before you start clicking. If a link looks interesting, capture it and move on. You can validate later. You can’t get back lost time.

A scope you can write at the top of the sheet:

- One focus page or one tight cluster

- 3-5 search competitors

- 30-50 referring domains per competitor (max)

- Output: 20-40 prospects grouped by authority tier and relevance

Example: if you sell a project management tool, choose your “Gantt chart template” page (or that cluster). You’re looking for the kinds of sites that link to similar resources, so you can later decide whether to pursue outreach, partnerships, or other options for hard-to-get authority placements.

Pick the right competitors without overthinking it

For competitor backlink gap analysis, you want search competitors, not business rivals. A company might compete with you on pricing or features and still not compete with you on Google.

Start with 5-10 queries that describe what you want to rank for. Keep them tight (same intent, same topic). Do a quick SERP scan and note who shows up again and again. You’re looking for repeat winners.

A simple way to choose 3-5 competitors:

- 2-3 sites that rank in the top 3-10 for most of your queries

- 1 site that’s close to you (often ranks 8-20) but seems to be moving up

- 1 content-first site (blog or niche publisher) that consistently covers your topic well

Include one smaller site that’s rising quickly. Their link choices are often more realistic to copy.

Exclude huge marketplaces and giant platforms if they distort the data. They can dominate SERPs with brand power and massive link profiles, which won’t tell you what works for a normal site.

Example: if you sell accounting software, a massive app directory may rank for “best accounting tools,” but their backlinks aren’t a useful model. A fast-growing niche review site and two mid-sized SaaS competitors will give you a cleaner gap list.

Collect a small, useful backlink sample (no giant exports)

The fastest way to ruin competitor backlink gap analysis is to export thousands of rows and then stare at them. You don’t need every backlink. You need a tight sample that shows (1) where competitors get real authority and (2) what topics those links support.

Start with referring domains, not individual URLs. Domains are easier to compare and show the real shape of a competitor’s link profile.

Use two quick filters:

- strongest sources first (sorted by the authority metric in your tool)

- recent activity (last seen or first seen date) so you’re not copying links from years ago

For most sites, 50-150 referring domains per competitor is enough to spot patterns without getting lost.

When you copy into a sheet, capture only what you’ll use later: referring domain, one example linking page, anchor snippet, link type (if your tool labels it), and optional date seen.

Duplicates aren’t a problem. They’re a signal. If the same domain shows up across multiple competitors, keep it and tag it as shared (a simple “C1/C2/C3” marker works).

Example: you pull 100 referring domains for three competitors and notice 12 domains appear in all three lists. That cluster is often the baseline layer in the niche (trade publications, review sites, common resource lists). Strong domains that appear for only one competitor can point to a unique relationship or a tough placement worth investigating.

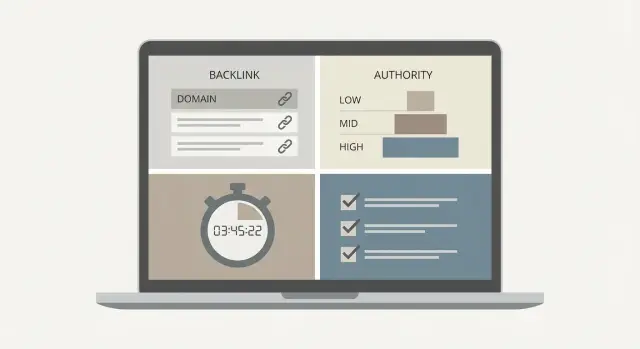

Sort links into authority tiers in 10 minutes

This step keeps your analysis from turning into a messy pile of domains. You’re not trying to score every link perfectly. You’re trying to see the shape of authority: what level of sites your competitors regularly get that you don’t.

Pick one metric you already trust and stick to it for the whole pass (DR, DA, TF). Mixing metrics usually creates fake “insights” that are really just measurement noise.

A simple three-bucket setup is enough:

- Baseline: everyday sites in your space

- Strong: respected industry sites and well-known blogs that are harder, but realistic

- Top-tier: major publications, big company pages, standout authority domains

You don’t need perfect cutoffs. Use rough thresholds that fit your niche. A practical test: top-tier starts where you think, “We won’t get this from casual outreach.”

Now scan your competitor samples and mark outliers. One top-tier outlier can explain a ranking gap.

Scenario: you sell B2B analytics tools. Most competitor links sit in baseline and strong, but one competitor has several top-tier mentions from large tech publications and big engineering blogs. If your site has zero links in that top-tier bucket, that’s not a “more links” problem. It’s a missing authority layer.

Check topical relevance and link patterns quickly

After you’ve pulled a small sample, your next job is to decide what’s worth chasing. Speed matters. You’re not auditing the whole site. You’re asking: does this source make sense for your topic, and is there a repeatable pattern?

Give each source a simple relevance tag so you don’t overthink:

- same niche

- adjacent

- general press

- tools and vendor lists

- communities and associations

Then classify the placement type in a few seconds. You’re trying to understand effort and repeatability:

- editorial mention

- guest post

- partnership/integration

- resources page (best-of, recommended tools)

- profile/listing

Look for clusters. If three competitors keep getting links from “security checklists,” “pricing comparisons,” or “developer docs,” that’s a signal. Clusters are often more useful than single impressive domains because they point to content themes that earn links repeatedly.

Move fast past anything that looks off. Flag and skip sources with irrelevant topics, spun content, unnatural anchors, or pages that exist only to sell links.

Turn findings into a prioritized gap list

Your notes only matter if they turn into a short list you can act on this week. Once you’ve finished the pass, stop collecting and start selecting.

Bucket your prospects by effort:

- Easy matches: clear contribution paths or obvious fit (they already link to similar pages)

- Medium effort: needs a stronger angle (data, a tool page, a better resource)

- Hard but valuable: top-tier or very selective publishers (keep this short)

Within each bucket, sort using three checks: are you missing that authority tier, does the topic match the target page, and can you repeat this type of placement again later?

Add one sentence for “why it matters” on every item. Example: “Links to competitors’ pricing pages, same audience, and sits in our missing mid-tier industry publications.”

If you want a simple scoring method, rate each factor 1-3 and total it:

- authority tier gap

- topic fit

- repeatability

Keep your final output to 10-20 prospects. If your list becomes mostly “hard but valuable,” it’s a sign you need to balance it with a few more realistic wins while you work toward the top tier.

Under-an-hour workflow (minute-by-minute)

Minute-by-minute plan

- 0-5: Set the scope (one target page or cluster) and pick 3-5 true search competitors.

- 5-20: Pull a small sample of the best referring domains for each competitor. Skip giant exports.

- 20-35: Combine into one sheet, tag duplicates, and sort into authority tiers.

- 35-50: Add two quick labels per domain: topical fit and suspected link type.

- 50-60: Pick your 10 best gaps, assign an owner, and set a simple metric (for the target page).

Keep decisions simple. High authority plus high topical fit is usually worth attention even if you don’t yet know the exact method.

Example: if two competitors both have links from well-known engineering blogs and you have none, that’s a missing top-tier layer. Your next actions might be one story angle, one supporting asset, and a short list of specific targets to pursue.

Common mistakes that waste time (and how to avoid them)

Most “quick” backlink work gets slow when you start chasing interesting links instead of answering the core question: what links can you realistically earn that your competitors already have and you don’t?

Common time sinks:

- Using the wrong competitors. Fix: choose sites that outrank you for the same terms and match your niche.

- Obsessing over one metric. Fix: use authority as a filter, then decide based on topical fit and whether the link makes sense on a real page.

- Mixing homepage and deep-page links. Fix: label each link as homepage vs deep page and note the page type (blog, tools, docs, pricing).

- Copying one-off PR wins. Fix: ask if you could create a similar reason to be linked. If not, mark it not repeatable.

- Spending 30 minutes on one domain. Fix: time-box domains to 2-3 minutes. If it’s unclear, move on.

Example: you find a Fortune 500 engineering blog linking to a competitor’s research page. Check if it’s a one-time mention or part of a recurring resource pattern. Recurring patterns belong on your short list.

Quick checklist before you call it done

Before you close your tabs, make sure you did a small, clean analysis, not a data dump.

- One page or one tight topic cluster

- 3-5 competitors taken from real search results

- A capped sample you can scan

- Authority tiers marked, with at least one missing tier identified

- Simple topical labels, with off-topic sources removed

- 1-2 repeatable link patterns you can describe in plain language

Then write next steps as tasks, not ideas. You want 10 items you could hand to someone.

One last sanity check: if all your competitors have at least a few links from high-authority sources and you have none, state it clearly as your missing top-tier layer. That single insight often sets the next month of priorities.

Example: finding a missing top-tier authority layer

A B2B SaaS company selling invoice automation was stuck on page 2 for “invoice automation software.” Their on-page work was solid, and they had plenty of small mentions, but rankings wouldn’t move.

They ran a fast gap analysis using a small sample: about 30 referring domains per site from three competitors ranking in the top five. Two competitors had mid-tier niche coverage plus a few top-tier editorial links that looked hard to get.

After sorting into tiers, the gap was obvious:

- Their site: lots of Tier 3 (small blogs, low-value directories, partner pages), almost no Tier 1

- Competitor A: a few Tier 1 mentions plus steady Tier 2 industry sites

- Competitor B: fewer total links, but 2-3 Tier 1 placements on well-known tech and business publishers

- Competitor C: mostly Tier 2, but repeating patterns (same topic pages, similar anchor themes)

Once you see a missing layer, you don’t need a huge list. You need a short set of targets that explain why Google trusts the winners.

They built a by-tier target list and a few content angles that matched what the top-tier links were pointing to: a benchmark report, an ERP integration guide with screenshots, and a security/compliance explainer.

Next steps: how to close the gaps you found

Pick your top 10 prospects and decide how you’ll pursue each one based on tier and effort. Don’t try to cover everything. Focus on the missing layer.

A simple plan by tier:

- Tier 1: 2-3 long-term targets

- Tier 2: 3-5 realistic targets for this month

- Tier 3: 2-4 supporting targets that add topical depth

Then choose an approach for each target: build something worth citing, pitch it to the right places, or pursue a placement path that fits the publication’s normal model.

If your analysis shows a clear Tier 1 authority gap and you already know which domains you want, SEOBoosty can help by offering a curated inventory of high-authority sites where you can choose specific domains and subscribe to placements. For teams that don’t want long outreach cycles, that can be a practical way to fill the missing tier while you keep building repeatable, topic-driven links.

Track results against the target page you scoped at the start: weekly positions and organic clicks, plus notes on when links go live. If rankings don’t move, re-check two basics first: whether links point to the right page, and whether your content matches the search intent better than the competitors you studied.

FAQ

What’s the real goal of a competitor backlink gap analysis?

Focus on patterns that explain rankings, not on collecting every missing URL. A good gap analysis tells you which kinds of sites (and which kinds of placements) your competitors earn that you don’t, especially where you’re missing an authority tier or a clear topical match.

How can I do this in under an hour without getting lost?

Start with one target page or one tight topic cluster, then pick 3–5 search competitors that repeatedly rank for the same queries. Pull a small sample of referring domains (not huge exports), tag duplicates, sort by authority tiers, add quick relevance and placement-type notes, and finish with a short prioritized list you can act on this week.

Which competitors should I include (and who should I ignore)?

Use search competitors: sites that outrank you for the exact terms you care about. Business rivals can be irrelevant in Google, and giant platforms often distort the data, so prioritize repeat SERP winners that match your niche and intent.

What backlink types should I ignore right away?

Skip thin directories, spammy aggregates, link farms, and sitewide footer or blogroll links because they inflate counts without reliably improving rankings. Also skip weird one-offs like scraped pages, random forum scraps, and links to pages you would never recreate (expired promos or temporary campaigns).

Should I compare individual backlinks or referring domains?

Sort by referring domains first because it shows the real shape of a competitor’s link profile and makes comparisons simpler. Individual URLs often create noise through duplicates, sitewide links, and repeated pages across subdomains.

What is an “authority tier gap,” and why does it matter?

An authority tier gap is when competitors have mentions from high-trust publications, major company pages, or standout industry sites and you have none (or very few). Closing that gap often requires fewer links than you think, because a small number of top-tier placements can outweigh many low-value ones.

How do I judge topical relevance quickly?

Topical fit is how closely the linking source matches your audience and the page you’re trying to rank. Strong relevance usually beats generic coverage, so tag sources quickly (same niche, adjacent, general press, vendor lists, communities) to keep your focus on links that are likely to move the target page.

Which SEO metrics should I use for sorting links into tiers?

Pick one authority metric you already trust in your tool and stick to it for the whole pass. Mixing DR, DA, and other scores tends to create false conclusions, so keep the measurement consistent and use relevance and placement type to make the final call.

What should I do with domains that show up for multiple competitors?

Duplicates are a useful signal, not a cleanup problem. If the same domain links to multiple competitors, it often represents a baseline source in the niche, and it’s usually a higher-priority prospect than a domain that appears only once with no clear pattern.

How do I turn the gap analysis into next steps I can execute?

Turn your notes into 10–20 prospects grouped by effort and value, and write one sentence on why each target matters for your scoped page. If you already know which top-tier domains you want and don’t want long outreach cycles, a service like SEOBoosty can help by letting you select from a curated inventory of high-authority placements to fill a missing authority layer while you keep building repeatable, topic-driven links.